tax shield formula for depreciation

Therefore the company can achieve a tax shield of 20000 by leveraging its. Web Each year this results in some amount of depreciation expense for tax purposes.

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

Will receive as a result.

. Tax Shield Deduction x Tax Rate. All you need to do is multiply. It is important to have the depreciation numbers along with the.

Web For some calculations such as free cash flow putting back a tax shield can not be as straightforward as just adding the entire tax shields worth. The applicable tax rate is 37. Web To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which.

Tax Shield Formula Breaking Down Tax Shield Can You Use Real Estate Depreciation To Offset Ordinary. For example Below we have two segments. Web The formula for calculating the depreciation tax shield is as follows.

Web Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield. Instead add the interest of. Web The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction.

Web Content Does Tax Shield Include Depreciation. Web There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. Web The maximum depreciation expense it can write off this year is 25000.

Web The effect of a tax shield can be determined using a formula. Tax rate 40 The. The tax shield Johnson Industries Inc.

Tax Shield Deduction x Tax Rate. Depreciation tax shield Depreciation expense x tax rate. This is usually the deduction multiplied by the tax rate.

Web The effect of a tax shield can be determined using a formula. This is usually the deduction multiplied by the tax rate. The Depreciation Tax shield directly affects Income Taxes paid ie.

Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense. The formula for calculating a depreciation tax shield is easy. Web You calculate depreciation tax shield by taking 100000 X 20 20000.

Web Depreciation tax shield formula.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Effective Tax Shield Of Corporate Debt Download Table

Tax Shield Formula How To Calculate Tax Shield With Example

Risky Tax Shields And Risky Debt An Exploratory Study

Depreciation Tax Shield Formula And Calculation

Tax Shield Formula Step By Step Calculation With Examples

How To Calculate Ebitda Consolidated Funding

Depreciation Tax Shield Finance

Ppt Chapter 21 Powerpoint Presentation Free Download Id 4710282

Depreciation Tax Shield Explained All You Need To Know

To Get The Operating Cash Flow Given The Net Income We Add Back

Double Declining Depreciation Calculator Calculator Academy

What Is The Depreciation Tax Shield The Ultimate Guide 2021

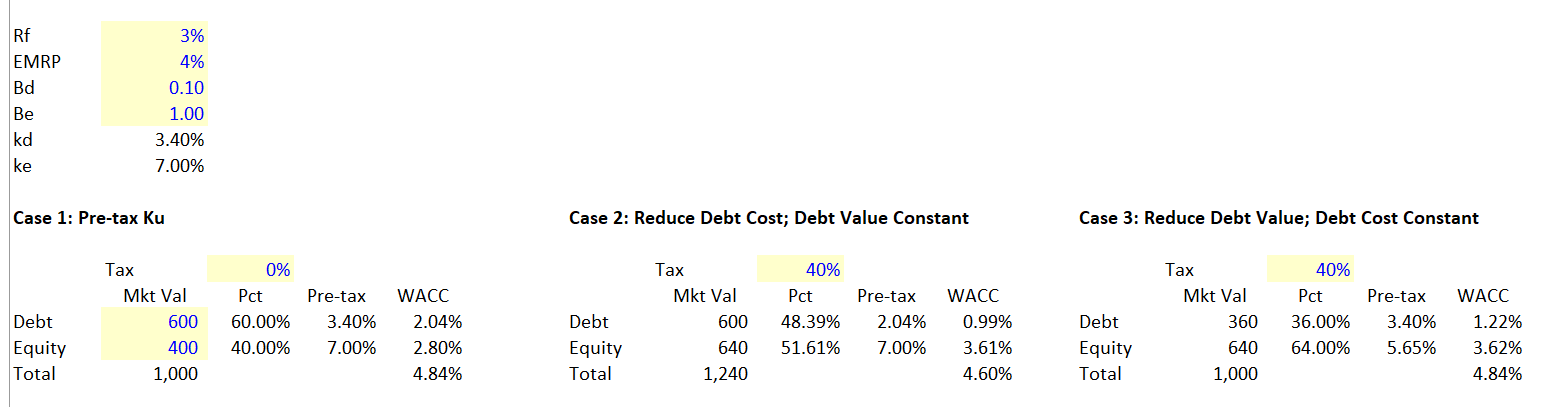

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Risky Tax Shields And Risky Debt An Exploratory Study

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Depreciation Tax Shield The Ultimate Guide 2021

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com